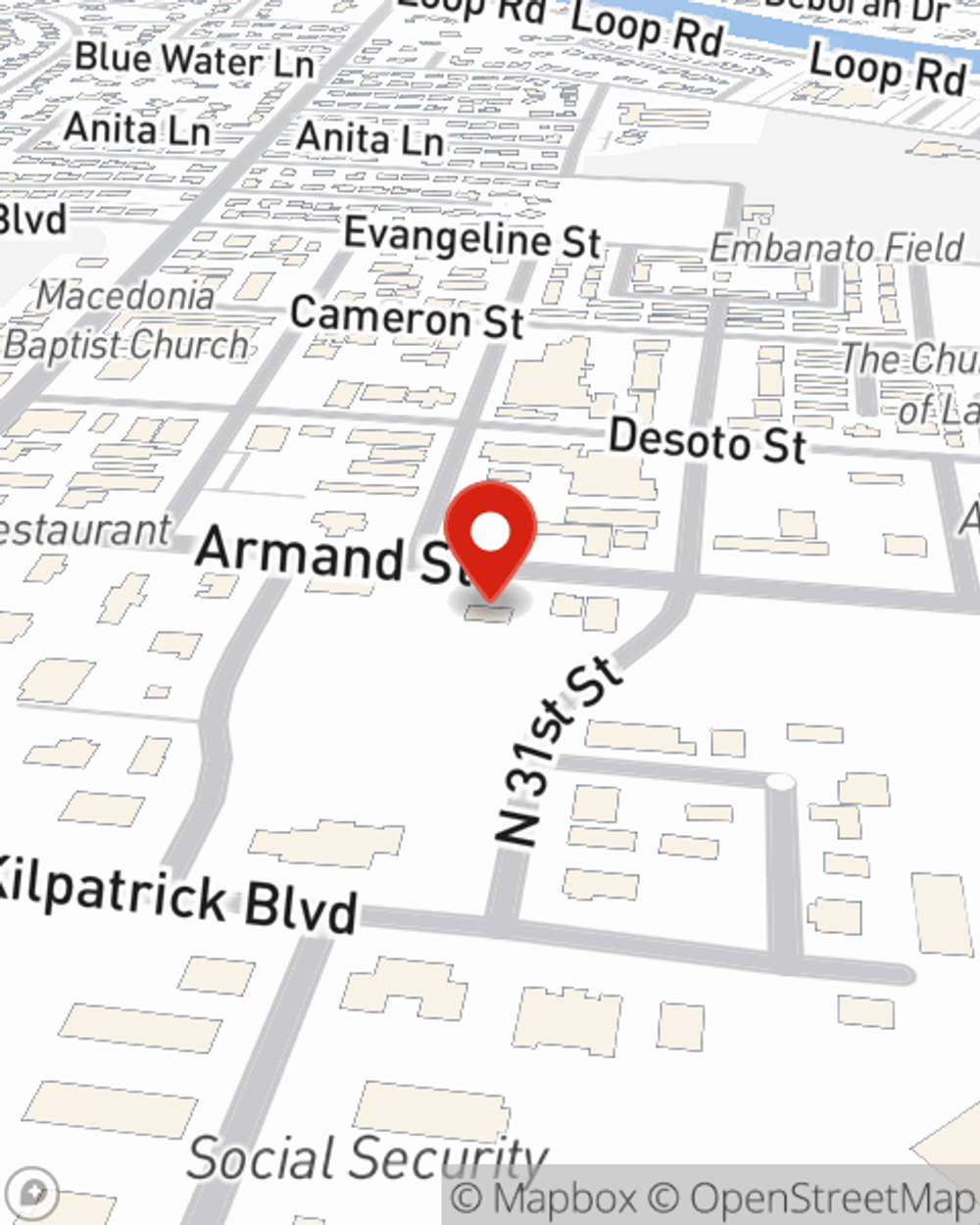

Business Insurance in and around Monroe

Calling all small business owners of Monroe!

Insure your business, intentionally

Business Insurance At A Great Value!

As a business owner, you have to think about all areas of business, all the time. The details can be overwhelming! You can save time by working with State Farm agent Greg Manley, Jr.. Greg Manley, Jr. gets where you are because all State Farm agents are business owners themselves. You'll get a business policy that covers your concerns and frees you to focus on growing your business into the future.

Calling all small business owners of Monroe!

Insure your business, intentionally

Customizable Coverage For Your Business

For your small business, whether it's an art gallery, a hobby shop, an antique store, or other, State Farm has insurance options to help fit your needs! This may include coverage for things like business property, computers, and accounts receivable.

At State Farm agent Greg Manley, Jr.'s office, it's our business to help insure yours. Visit our terrific team to get started today!

Simple Insights®

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.

Greg Manley, Jr.

State Farm® Insurance AgentSimple Insights®

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.